SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

the Securities Exchange Act of 1934 (Amendment No. )

![[MISSING IMAGE: cov_proxy-4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/cov_proxy-4c.jpg)

![[MISSING IMAGE: lg_principalreg-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/lg_principalreg-pn.jpg)

Notice of 2021 Annual Meetingof Shareholders and Proxy Statement

Dear Fellow Shareholders:

You are invited to attend the annual meeting of shareholders on Tuesday, May 18, 2021, at 9:00 a.m., Central Daylight Time. Due to the continuing public health impact of the coronavirus outbreak (i.e., COVID-19) and to support the health and well-being of

The notice of annual meeting and proxy statement provide an outline of the business to be conducted at the meeting. We will also report on the progress of the Company and answer shareholder questions.

We encourage you to read this proxy statement and vote your shares. You may complete, date and sign a proxy or voting instruction card and return it in the envelope provided (if these materials were received by mail) or vote by using the telephone or the internet. Thank you for acting promptly.

Sincerely,

Daniel J.CEO

Chairman, President, and Chief Executive Officer

Principal Financial Group®

| | Sincerely, ![[MISSING IMAGE: sg_danhouston-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/sg_danhouston-pn.jpg) Daniel J. Houston Chairman, President, and CEO Principal Financial Group | | | ![[MISSING IMAGE: ph_danhouston-lrgbw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_danhouston-lrgbw.jpg) | |

![[MISSING IMAGE: lg_principalreg-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/lg_principalreg-pn.jpg)

Lead Director

Principal Financial Group®

| | ![[MISSING IMAGE: sg_scottmills-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/sg_scottmills-bw.jpg) Scott Mills Lead Director Principal Financial Group | | | ![[MISSING IMAGE: ph_scottmills-lrgbw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_scottmills-lrgbw.jpg) | |

| | Proposals: | | | | Our Board’s Recommendation: | | ||||

| 1. | | | Election of four Directors for three-year terms | | | | ![[MISSING IMAGE: ic_tickmark-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmark-pn.jpg) FOR each FOR eachSee page 10 | | ||

| 2. | | | Advisory approval of the compensation of our named executive officers | | | | ![[MISSING IMAGE: ic_tickmark-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmark-pn.jpg) FOR FORSee page 66 | | ||

| 3. | | | Ratification of the appointment of Ernst & Young LLP as the Company’s independent auditors for | | | | ![[MISSING IMAGE: ic_tickmark-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmark-pn.jpg) FOR FORSee page 67 | | ||

1.Elect four Directors;2.Hold an advisory voteShareholders will also be able toapprove the compensation of our named executive officers;3.Ratify the appointment of Ernst & Young LLP as the Company's independent auditors for 2021;4.Approve the Principal Financial Group, Inc. 2021 Stock Incentive Plan; and5.Transacttransact such other business as may properly come before the meeting.The Company has not received notice of other matters that may be properly presented at the annual meeting.You can vote if you were a shareholder of record on March24, 2021.27, 2024. It is important that your shares be represented and voted at the meeting.Please vote by any oneBy Order of thefollowing methods:Board of Directors![[MISSING IMAGE: sg_natalielamarque-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/sg_natalielamarque-bw.jpg) Natalie Lamarque

Natalie Lamarque

Executive Vice President, General Counsel and SecretaryApril 8, 2024Approximate Date of Commencement of Mailing of Proxy Materials: April 8, 2024 Meeting Information Internet![[MISSING IMAGE: ic_meeting-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_meeting-pn.gif)

Telephone MailMeeting date:Tuesday, May 21, 2024

![[MISSING IMAGE: ic_meetingtime-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_meetingtime-pn.gif)

Time:9:00 a.m., Central Daylight Time

Time:9:00 a.m., Central Daylight Time

![[MISSING IMAGE: ic_location-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_location-pn.gif)

Location:This will be a virtual only meeting which you can join at: www.meetnow.global/MVC9L9P. Voting Your vote is important! Please take a moment to vote by internet, telephone, or proxy or voting instruction card as explained in the How Do I Vote sections of this proxy statement. ![[MISSING IMAGE: ic_globe-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_globe-pn.gif)

Through theInternet:internet:visit the website noted in the notice of internet availability of proxy materialsshareholdersthat you received by mail, on the proxy or voting instruction card, or in the instructions in the email message that notified you of the availability of the proxy materials.

![[MISSING IMAGE: ic_telephone-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_telephone-pn.gif)

By telephone:call the toll-free telephone number shown on the proxy or voting instruction card or the instructions in the email message that notified you of the availability of the proxy materials.

![[MISSING IMAGE: ic_mail-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_mail-pn.gif)

MailComplete, sign, and promptly return a proxy or voting instruction card in the postage paid envelope provided. By Order of the Board of Directors

Christopher J. LittlefieldExecutive Vice President, General Counsel and SecretaryApril 5, 2021

IMPORTANT NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS

FOR THE SHAREHOLDER MEETING TO BE HELD ON MAY 18, 2021:

May 21, 2024:

www.principal.com/

Your vote is important! Please take a moment to vote by internet, telephone or proxy or voting instruction card as explained in the How Do I Vote sections of this document.

| | ||||||

| | | Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | | | 1 | |

| | Notice of Annual Meeting of Shareholders | | | | | 1 | | |

| | | | | | | | ||

| | Table of Contents | | | | | 2 | | |

| | | | | | | | ||

| | Proxy Summary | | | | | 3 | | |

| | | | | | | | ||

| | Corporate Snapshot | | | | | 3 | | |

| | | | | | | | ||

| | Year Over Year Performance Highlights | | | | | 4 | | |

| | | | | | | | ||

| | Industry Recognition | | | | | 5 | | |

| | | | | | | | ||

| | Director Qualifications, Director Tenure, Process for Identifying and Evaluating Director Candidates, and Diversity of the Board | | | | | |||

| | |||||||

| | | | | | | | ||

| | Proposal One—Election of Directors | | | |||||

| | | | |||||

| | | | | | | | ||

| | Corporate Governance | | | |||||

| | | | |||||

| | | | | | | | ||

| | | | | | 20 | | | |

| | | | | | | | ||

| | | | | | 21 | | | |

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | Compensation of Non-Employee Directors | | | |||||

| | | | |||||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | Executive Compensation | | | |||||

| | | | |||||

| | | | | | | | ||

| | | | | | 33 | | | |

| | | | | | 33 | | | |

| | | | | | 33 | | | |

| | | | | | 34 | | | |

| | | | | | | | ||

| | | | | | ||||

| | |||||||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | Base Salary

| | | | | | |

| | | | | | | | ||

| | | | | | 44 | | | |

| | | | | | | | ||

| | Benefits

| | | | | | | |

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | Gross-Up Policy

| | | | | |||

| | |||||||

| | | | | | | | ||

| | | | | |

| |

|

|

|

|

|

|

|

|

Summary Compensation Table | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | Pension Plan Information

| | | | | | | |

| | | | | | | | ||

| | | | | | | | ||

| | Non-Qualified Deferred Compensation

| | | | | |||

| | |||||||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | 62 | | | |

| | | | | | 63 | | | |

| | | | | | 64 | | | |

| | | | | | 64 | | | |

| | | | | | ||||

| | | |||||||

| | Proposal | | | | | | | |

| | | | | | ||||

| | | |||||||

| | Proposal | | | | | | | |

| | | | | | | | ||

| | Audit-Related Fees

| | | | | | | |

| | | | | | | | ||

| | | | | | | | ||

| | | | | | ||||

| | | |||||||

| | Security Ownership of Certain Beneficial Owners | | ||||||

| ||||||||

| | | | ||||||

| | |||||||

| | | |||||||

| | | | | | 70 | | | |

| | | | | | | | ||

| | Questions and Answers About the Annual Meeting | | | | | 71 | | |

| | | | | | ||||

| | | |||||||

| | |||||||

Appendix | | | | | | | ||

| | | | | | | | ||

| | Appendix | | | | |

| |

|

|

|

|

|

|

|

|

| | | | Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | | | 2 | |

| | | | | | | | | |||

| | | | | | | | | |||

| | | | | | | | |

![[MISSING IMAGE: fc_corpsnapshot-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/fc_corpsnapshot-pn.jpg)

| | | | Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | | | 3 | |

| | Dividend per share ![[MISSING IMAGE: bc_performance-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/bc_performance-pn.jpg) | | | | 2023 Pre-tax operating earnings1 ![[MISSING IMAGE: pg_financial-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/pg_financial-pn.jpg) | |

| | Company Highlights | | | | Business Unit Highlights | | | | ||

| | ![[MISSING IMAGE: ic_tickmarkblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.jpg) Returned $1.3 billion of capital to shareholders in 2023, including $0.7 billion of share repurchases and $0.6 billion in common stock dividends ![[MISSING IMAGE: ic_tickmarkblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.jpg) Strong capital position with $1.7 billion of excess and available capital at year-end | | | | ![[MISSING IMAGE: ic_tickmarkblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.jpg) Retirement and Income Solutions full-year sales increased 9% over 2022, including $2.9 billion of pension risk transfer sales ![[MISSING IMAGE: ic_tickmarkblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.jpg) Principal Global Investors managed AUM of $499.5 billion, increased 7% over 2022 ![[MISSING IMAGE: ic_tickmarkblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.jpg) Principal International reported record AUM of $180.4 billion, increased 15% over 2022 ![[MISSING IMAGE: ic_tickmarkblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.jpg) Specialty Benefits premium and fees increased 9% over 2022, driven by record full-year sales, strong retention, and employment and wage growth | | | | | |

| | | | | | | | | | ||

| | | | Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | | | 4 | |

| | Overall | | | | Retirement and Income Solutions | |

| | ![[MISSING IMAGE: ic_tickmarkblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.jpg) 236 on Fortune magazine’s list of the Largest 500 Corporations based on revenues (Feb 2024) | | | | ![[MISSING IMAGE: ic_tickmarkblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.jpg) Top 3 401(k) recordkeeper based on number of participants. 2023 PLANSPONSOR Defined Contribution Plan Recordkeeping Survey. (July 2023) | |

| | | | | | ![[MISSING IMAGE: ic_tickmarkblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.jpg) No. 1 defined benefit plan service provider. PLANSPONSOR Defined Benefit Administration Survey. (August 2023) | |

| | | | | | ![[MISSING IMAGE: ic_tickmarkblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.jpg) No. 1 ESOP service provider. 2023 PLANSPONSOR Defined Contribution Plan Recordkeeping Survey. (July 2023) | |

| | | | | | ![[MISSING IMAGE: ic_tickmarkblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.jpg) CIO Industry Innovation—Winner Real Assets and Infrastructure Award (December 2023) | |

| | Asset Management | | | | Benefits and Protection | |

| | ![[MISSING IMAGE: ic_tickmarkblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.jpg) Ranked 27th largest manager of worldwide institutional assets under management of 434 managers profiled. Assets as of December 31, 2022. (“Largest Money Manager” Pensions & Investments. June 2023) | | | | ![[MISSING IMAGE: ic_tickmarkblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.jpg) No.1 Non-Qualified Deferred Compensation provider. 2023 PLANSPONSOR Defined Contribution Plan Recordkeeping Survey. (July 2023) | |

| | Workplace Excellence | | | | Sustainability Management | |

| | ![[MISSING IMAGE: ic_tickmarkblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.jpg) Named a Best Place to Work in Money Management by Pensions & Investments for the 12th consecutive year. (December 2023) ![[MISSING IMAGE: ic_tickmarkblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.jpg) Scored 100 out of 100 on the Diversity: IN Disability Equality Index (DEI) for our disability inclusion efforts. (July 2023) | | | | ![[MISSING IMAGE: ic_tickmarkblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.jpg) CDP Climate Change Management status of “B”. (February 2024) ![[MISSING IMAGE: ic_tickmarkblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.jpg) Included in the JUST 100 as one of 2024 America’s Most JUST Companies by JUST Capital (February 2024) | |

| | | | Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | | | 5 | |

| | Board Skills and Attributes Assessment | | | | The | |

| | Director Nomination Process | | | | The Committee reviews the performance of each Director whose term is expiring as part of the determination of whether to recommend the Director for reelection to the Board. As part of this process, the Committee receives input from the other Directors, and to the extent engaged, an independent consultant. The Nominating and Governance Committee evaluates Director performance and capabilities against desired characteristics and relevant considerations, including those noted above. | |

| | Feedback and Action | | | | Following the Nominating and Governance Committee’s discussion, the independent consultant, if one is used, or the Committee Chair provides feedback to the Directors who were evaluated. The Board annually conducts a self-evaluation regarding its effectiveness, and the Audit, Finance, Human Resources, and Nominating and Governance Committees also annually evaluate their respective performance. | |

| | All Board members have: | | | | ![[MISSING IMAGE: ic_tickmarkblue-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.gif) Personal character that supports the Company’s core value of integrity; | | | | ![[MISSING IMAGE: ic_tickmarkblue-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.gif) Training or experience that is useful to us in light of our strategy, initiatives, and risk factors; and | | | | ![[MISSING IMAGE: ic_tickmarkblue-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_tickmarkblue-pn.gif) A demonstrated willingness and ability to prepare for, attend, and participate effectively in Board and Committee meetings. | |

| | | | Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | | | 6 | |

All Board members have:

•Personal character that supports the Company's core value of integrity;•Training or experience that is useful to Principal in light of its strategy, initiatives and risk factors; and•A demonstrated willingness and ability to prepare for, attend and participate effectively in Board and Committee meetings.

Several current independent Directors have led businesses or major business divisions as Chief Executive Officer ("CEO"), President, or Executive Vice President (Mr. Auerbach, Ms. Beams, Mr. Dan, Mr. Hochschild, Mr. Mills, Ms. Nordin, Mr. Pickerell, Ms. Richer, Mr. Rivera and Ms. Tallett).

|

|

|

|

|

|

|

|

|

|

Company's Company’s strategy, initiatives, and operations for which independent Directors have specific training and executive level experience that assists them in their Board responsibilities.

| | | | | Auerbach | | | Beams | | | Carter-Miller | | | Hochschild | | | Mills | | | Muruzabal | | | Mitchell | | | Nordin | | | Rivera | | | Pickerell | | | Richer | |

| | Senior Executive Experience | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | |

| | Accounting & Finance | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | |

| | Asset & Investment Management | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | |

| | Consumer (Retail) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | |

| | Executive Compensation | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | |

| | Financial Services | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | |

| | Human Resources/Talent Management | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | |

| | International | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | |

| | Marketing | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | |

| | Mergers & Acquisitions | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | |

| | Product Development | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | |

| | Risk Management | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | |

| | Strategic Planning | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | |

| | Sustainability/ESG | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | | |

| | Technology | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | | | | | | | | | | | | ![[MISSING IMAGE: ic_circleblue-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ic_circleblue-pn.jpg) | |

| | | | Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | | | 7 | |

![[MISSING IMAGE: pc_gender-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/pc_gender-pn.jpg)

![[MISSING IMAGE: pc_racial-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/pc_racial-pn.jpg)

| | Board Diversity Matrix (As of 4/8/2024) | | ||||

| | Total Number of Directors | | | | 12 | |

| | | | | | Female | | | | Male | | | | Non-Binary | | | | Did Not Disclose Gender | |

| | Gender Identity | | | | | | | | | | | | | | | | | |

| | Directors | | | | 51 | | | | 72 | | | | 0 | | | | 0 | |

| | Demographic Background | | | | | | | | | | | | | | | | | |

| | African American or Black | | | | 13 | | | | 14 | | | | 0 | | | | 0 | |

| | Alaskan Native or Native American | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

| | Asian | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

| | Hispanic or Latinx | | | | 0 | | | | 25 | | | | 0 | | | | 0 | |

| | Native Hawaiian or Pacific Islander | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

| | White | | | | 46 | | | | 47 | | | | 0 | | | | 0 | |

| | Two or More Races or Ethnicities | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

| | LGBTQ+ | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

| | Did Not Disclose Demographic Background | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

| | | | Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | | | 8 | |

![[MISSING IMAGE: bc_boardrefresh-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/bc_boardrefresh-pn.jpg)

The Board's diversity objective reflects the values of the Company as well. Principal has long been recognized as an exceptional place to work.

•In 2020, Pensions and Investments placed Principal on its list of Best Places to Work in Money Management for companies with 1,000 or more employees for the eighth consecutive year;•IDG's Computerworld named Principal one of the 100 Best Places to Work in Information Technology for the 19th year, ranking No. 32; and•Earlier this year, Fortune magazine named Principal one of its 2021 Most Admired Companies.

PrincipalApril 8, 2024, is consistently recognized for its commitment to fostering a diverse and inclusive environment where employees can thrive, advance, and share their unique perspectives.

•In 2020, Principal was again named to Forbes' list of Best Places for Women to Work;•Principal was again named one of Working Mother magazine's 100 Best Companies;•Principal was recognized for the 20thtime as one of the National Association of Female Executives' Top Companies for Executive Women;•Forbes named Principal one of America's Best Employers for Diversity;•Principal earned a perfect score on Disability:IN's Disability Equality Index;

| | 2019 | | | | 2020 | | | | 2021 | | | | 2022 | | ||||||||

| | ![[MISSING IMAGE: ph_auerbachjonathan-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_auerbachjonathan-bw.jpg) Jonathan S. Auerbach | | | | ![[MISSING IMAGE: ph_riveraalfredo-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_riveraalfredo-bw.jpg) Alfredo Rivera | | | | ![[MISSING IMAGE: ph_richerclare-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_richerclare-bw.jpg) Clare S. Richer | | | | ![[MISSING IMAGE: ph_muruzabalclaudio-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_muruzabalclaudio-bw.jpg) Claudio N. Muruzabal | | | | ![[MISSING IMAGE: ph_beamsmaliz-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_beamsmaliz-bw.jpg) Mary E. “Maliz” Beams | | | | ![[MISSING IMAGE: ph_mitchellliz-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_mitchellliz-bw.jpg) H. Elizabeth Mitchell | |

| | | | Notice of 2024 Annual Meeting of Shareholders and Proxy Statement | | | 9 | |

|

|

|

|

|

|

|

|

|

|

•Principal was recognized as one of the Ethisphere Institute's World's Most Ethical Companies for the sixth consecutive year (and 10th year overall), emphasizing the commitment to leading ethical business standards and practices. Only five companies in the financial services industry earned this distinction in 2020;•Principal maintains 13 Employee Resource Groups and Networks in which more than 4,000 employees participate that connect employees based on similar interests or aspects of diversity, including gender equality, LGTBQ+ issues, racial equality, enabling all abilities, valuing military experience and sustainability;•Principal ranked #32 on Diversity MBA's 50 Out Front: Best Companies to Work for Women and Diverse Managers;•Principal was named a member of the 2021 Bloomberg Gender-Equality Index; and•And for the 6th straight year, we received a score of 100/100 on the Corporate Equality Index, naming us one of the "Best Places to Work for LGBTQ Equality".

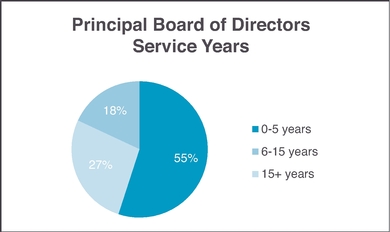

The Board's effectiveness benefits from Directors who have the necessary skills, backgrounds and qualifications and who also increase the Board's diversity. Director tenure and Board refreshment are important topics that receive considerable Board focus. The Board believes that its thorough Director performance reviews and healthy Board refreshment processes better serve Principal and its stakeholders than would mandatory term limits. Strict term limits would require that Principal lose the continuing contribution of Directors who have invaluable insight into Principal and its industry, strategies and operations because of their experience. Nevertheless, Directors' terms must not extend past the annual meeting following their 72nd birthday. The tenure of the independent Directors, following retirements that will occur immediately following the 2021 Shareholders Meeting, is listed below. The average tenure of Principal's independent Directors will be 7.27 years.

The tenure of the Directors, as reflected in the chart above, balances deep knowledge of the Company, its industry and relevant issues, with fresh perspectives and additional expertise, while providing the oversight and independence needed to meet the interests of our shareholders.

One tenured Director will retire immediately following our 2021 Annual Shareholders Meeting and two additional directors will retire over the next two years continuing our process of regularly refreshing the talents and perspectives reflected on our Board.

Communicating with stakeholders including clients, customers, employees, and investors, has always been an important part of how Principal conducts its business. Principal has had in place for some time a formal engagement process with shareholders around matters of corporate governance. These discussions provide us with helpful insight into shareholders' views on current governance topics, which are then discussed with the Nominating and Governance Committee and the full Board. This continuing process regularly supplements relevant communications regarding corporate governance made through the Company's website and by its Investor Relations staff.

The Nominating and Governance Committee will consider shareholder recommendations for Director candidates sent to it c/o the Company Secretary. Director candidates nominated by shareholders are evaluated in the same manner as Director candidates identified by the Committee and search firms it retains. In addition, a shareholder or group of up to 20 shareholders, owning 3% or more of the Company's outstanding common stock ("Common Stock") continuously for at least three years, can nominate director candidates, constituting up to 20% of the Board, in the Company's annual meeting proxy materials.

|

|

|

|

|

|

|

|

|

|

On February 21, 2021, PFG entered into a cooperation agreement (the "Cooperation Agreement") with Elliott Investment Management L.P. and certain of its affiliates (collectively, "Elliott"). The below is a summary of the Cooperation Agreement, which does not purport to be complete and is qualified in its entirety by reference to that agreement, a copy of which is attached as Exhibit 10.1 to our Current Report on Form 8-K filed with the Securities and Exchange Commission on February 22, 2021. and is incorporated herein by reference (the "8-K").

Pursuant to the Cooperation Agreement, the Board, upon the recommendation of the Nominating and Governance Committee (the "Nominating Committee"), appointed Mary Elizabeth "Maliz" Beams to the Board and to the Board's Finance Committee (the "Finance Committee"). Ms. Beams was appointed as a Class I member of the Board, with an initial term expiring at the 2023 Annual Meeting of Shareholders. She will receive compensation consistent with that received by the Company's other non-employee Directors. She also entered into a customary indemnification agreement with the Company in the same form entered into by the other Directors. The Board affirmatively determined, upon the recommendation of the Nominating Committee, that Ms. Beams qualifies as "independent" under the rules of the Nasdaq Global Select Market LLC.

In addition, the Company and Elliott agreed to cooperate to identify and mutually agree upon an additional independent Director with expertise and skills as determined by the Nominating Committee (together with Ms. Beams, the "New Directors"). The Board agreed to appoint the additional New Director to the Board by September 30, 2021, subject to customary on-boarding processes.

The Cooperation Agreement provides for customary Director replacement rights for the New Directors during the period ending on the 30th day prior to the deadline for the submission of stockholder nominations for non-proxy-access Director candidates for the Company's 2022 Annual Meeting of Shareholders (the "Cooperation Period") and similar rights apply if Ms. Beams ceases to serve on the Finance Committee prior to the Company's proposed Investor Day, which will occur on or before June 30, 2021 (the "Investor Day"). Elliott's rights in connection with identifying such substitutes terminate at such time as Elliott's net long economic exposure to the Company's common stock falls below 2%.

Under the terms of the Cooperation Agreement, Elliott agreed to abide by customary standstill restrictions (subject to certain exceptions relating to private communications to the Company) during the Cooperation Period, which restrictions terminate upon the occurrence of certain events, including, among other things, the Company's material breach of the Cooperation Agreement and the Company's entry into certain change of control and other extraordinary transactions. Under the Cooperation Agreement, Elliott has agreed to appear in person or by proxy at any annual or special meeting of the Company's stockholders held during the Cooperation Period and to vote (i) in favor of the slate of Directors nominated by the Board for election, and in accordance with the recommendations of the Board on all other proposals and (ii) against the removal of any incumbent Directors or the election of any Director nominees not recommended by the Board; provided, however, that if both Institutional Shareholder Services Inc. ("ISS") and Glass, Lewis & Co., LLC ("Glass Lewis") recommend otherwise with respect to any of the Company's proposals at any such meeting (other than proposals relating to the election or removal of Directors, the size of the Board, or filling vacancies on the Board), Elliott is permitted to vote in accordance with the ISS or Glass Lewis recommendation. The Company and Elliott also agreed to customary mutual non-disparagement obligations, and that the size of the Board would not be increased to greater than 14 members during the Cooperation Period.

Concurrently with their entry into the Cooperation Agreement, the Company and Elliott entered into an information sharing agreement (the "Information Sharing Agreement") to enable the Company to share with Elliott certain confidential information related to a review to be overseen by the Finance Committee in advance of the Investor Day.

There are no arrangements or understandings between Ms. Beams and any other person pursuant to which Ms. Beams was elected to the Board, other than with respect to the matters referred to in the 8-K.

|

|

|

|

|

|

|

|

|

|

Proposal One—Election of Directors

The

Directors that constitute the Board.

| | |||||||

|

| | | | Career Highlights: Mr. Hochschild retired from Discover Financial Services, Mr. Hochschild previously served as the Chief Marketing Officer of Discover Financial Services Mr. Hochschild has been a Director Key Skills and Qualifications: Mr. Hochschild technology. Education: Other Public Company Boards: Current: None Within Last Five Years: Discover Financial Services | |

| | | | ||

| | | 10 | |

| | ![[MISSING IMAGE: ph_danhouston-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_danhouston-bw.jpg) Daniel J. Houston Age: 62 Director Since: 2014 Committees: Executive (Chair) | | |

| |

| |

| | | | ||

| | | 11 | |

|

|

|

|

|

|

|

|

|

|

TABLE OF CONTENTS

| | |||

![[MISSING IMAGE: ph_dianenordin-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_dianenordin-bw.jpg) Diane C. Nordin Age: 65 Director Since: 2017 Committees: Audit (Chair) and Finance | | | |

| | |||

|

| |

| | | | |

| | | ||

| 12 | |

| ![[MISSING IMAGE: ph_riveraalfredo-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_riveraalfredo-bw.jpg) Alfredo Rivera  Age: 62 Director Since: |

| | | | Career Highlights:Mr. Rivera He helped lead 2021. Key Skills and Qualifications: Mr. Rivera sustainability/ESG. Education: Other Public Company Boards: None | |

| | | | ||

| | | 13 | |

|

|

|

|

|

|

|

|

|

|

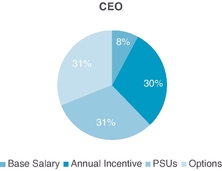

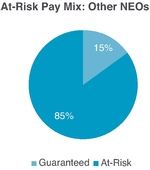

Blair C. Pickerell our shareholders. The Sessions generally occur at the start pricing risk; operational and business risk; and strategic risk. Committee regularly discusses the talent pipeline for critical roles at a variety of organizational levels, including CEO. A comprehensive review of executive talent, including assessments by an independent consulting firm engaged by the Human Resources Committee, determines Standard and Director Resignation Policy As of December 31, and Responsibilities Membership and responsibilities of each of the Board Committees: employees; and fulfill our purpose. As we continue to adapt and evolve this strategy, we will listen to and learn from our stakeholders, including clients, customers, investors, and employees. A full review of Our Directors serve on the Boards of Committee has the discretion to make a prorated grant of RSUs to Directors who join the Board at a time other than at the annual meeting. The . 2023. The Audit Committee also discussed with Ernst & Young LLP Exchange Commission. The Audit Committee Asset Management until February 10, 2024. Highlights Compensation Advisory each Named Executive Officer. equity termination provisions. decisions.1 The charts below show the The Committee set and approved the following target awards for our Named Executive Officers in In establishing the target award opportunity for Messrs. Houston The Committee considered internal equity when establishing Mr. Agrawal’s target award opportunity. dimensions. identified individual performance objectives Houston Strable-Soethout Dunbar Halter Valdés realized capital gains (losses) on funds withheld assets, minus change in fair value of funds withheld embedded derivative. All other benefits are targeted at market median in the aggregate, which supports the Named Executive Officers. See page 59 for details regarding benefits under the Executive Severance Plan. misconduct or failed in their responsibility to manage, monitor, or report the misconduct or risks giving rise to the misconduct. Houston Strable-Soethout Dunbar Halter Valdés Houston Strable-Soethout Dunbar Halter Valdés Name Houston Strable-Soethout Dunbar Halter Valdés Vested Grandfathered Participants were age 47 or older with at least ten years of service on December 31, 2005, and elected to retain the prior benefit provisions under the Defined Benefit ("DB") Plan and the NQDB and to forego receipt of the additional matching contributions offered under the 401(k) and Excess Plans. Currently, no Named Executive Officer is a Grandfathered Participant. 39.2% of Average Compensation (the highest five consecutive years' total Payout of the past ten years of Pay. "Pay" is the Named Executive Officer's base salary and annual incentive bonus up to the Tax Code limits) below the Integration Level(1) plus 61.25% of Average Compensation above the Integration Level. Cash Balance Plan—The Annual Pay Credits are calculated using the table below The NQDB benefit formula for Grandfathered Participants hired before January 1, 2002 is the greater of: • 65% of Average Compensation, offset by Social Security and DB Plan benefits; or • The greater of the traditional or cash balance DB Plan benefit for Grandfathered Participants without regard to Tax Code limits, offset by the benefit that can be provided under the DB Plan. (1) The Covered Compensation Table in the Tax Code. (2) The Social Security Taxable Wage Base. Non-Grandfathered Participants will receive the greater of the benefit provided under the Traditional Benefit Formula or the Cash Balance Formula. Traditional Formula—35% of Average Compensation below the Integration Level plus 55% of Average Compensation above the Integration Level. Cash Balance Formula—The Annual Pay Credits are calculated using the table below • Mr. Houston and Ms. Strable-Soethout earn benefits under the Traditional and Cash Balance Formulas. When benefits begin, they will receive the greater of the benefit under the Traditional Formula or Cash Balance Formula. • Mr. Dunbar most recently earned benefits under the Cash Balance Formula prior to his promotion on September 15, 2018. Mr. Dunbar also has a frozen benefit earned for service prior to January 1, 2010 where he will receive the greater of the Traditional Formula or Cash Balance Formula. • Mr. Halter has not accrued any benefit under this plan since January 1, 2010. When the frozen benefits are payable, he will receive the greater of the Traditional Formula of Cash Balance Formula. • Mr. Valdés primary retirement benefit will be the Cash Balance Formula. Mr. Valdés will also have a small benefit under the Traditional Formula due to service prior to January 1, 2006. The NQDB benefit formula for Non-Grandfathered Participants hired before January 1, 2002 is: • The traditional or cash balance pension plan benefit for Non-Grandfathered Choice Participants (whichever is greater) without regard to Tax Code limits, offset by the benefit that can be provided under the DB Plan. For employees who were active participants in the plan on December 31, 2005, their accrued benefit will not be less than their accrued benefit determined as of that date. There is a reduction for benefits paid under the Traditional Formula that begin prior to the Named Executive Officers attaining Normal Retirement Age: • Principal subsidizes early retirement if the Named Executive Officer remains employed until Early Retirement Age (age 57 with 10 years of service), which is the earliest date an employee may begin receiving retirement benefits. • The early retirement benefits for Grandfathered Choice Participants (and Non-Grandfathered Choice Participants for benefits accrued prior to January 1, 2006) range from 75% at age 57 to 100% at age 62. The early retirement benefits for Non-Grandfathered Choice Participants for benefits accrued after December 31, 2005 range from 75% at age 57 to 97% at age 64. • If the Named Executive Officer terminates employment before reaching Early Retirement Age, Principal Life does not subsidize early retirement. The early retirement benefits range from 58.6% at age 57 to 92.8% at age 64. • Benefits under the Traditional Formula are eligible for a Cost of Living Adjustment (COLA) after retirement benefits begin. For Non-Grandfathered Participants only benefits accrued as of December 31, 2005 receive this adjustment. The COLA is based on the Consumer Price Index. NQDB benefits may be paid as a lump sum at termination/retirement or as an annuity. Distributions may also be allowed at death or a change of control. For Houston Strable-Soethout Dunbar(3) Halter Valdés 2023. 2023. Improvement: For December 31, 2022, and December 31, 2023, SOA MIM2021-v3 model using historical data through 2019 (graduated from 2017). Houston Strable-Soethout Halter Dunbar Valdés Houston Strable-Soethout Dunbar Halter Valdés Qualified 401(k) Plan and Excess Plan The following are the investment options available to all participants in the Excess Plan; each option represents The following table illustrates the severance or contractual benefits that the Named Executive Officers would have received had they qualified for such benefits on December 31, Change of Control Employment Agreements specify that the Committee (as made up immediately prior to the Change of Control) determines whether awards will be settled in cash; applicable plan terms. Notice of 2024 Annual Meeting of Shareholders and Proxy Statement resolution at the Annual Meeting. Accounting Firm and our shareholders. “For” the ratification of the appointment of Ernst & Young LLP. 2022. and fees up to an established individual engagement and annual threshold. The policy requires specific preapproval of all other services. Pursuant to the policy, each quarter Principal management presents to the Committee a detailed description of each particular service that meets the definition of services that have been generally approved and each service for which specific preapproval is sought, and an estimate of fees for each service. The policy accords the Audit Committee Chair authority to preapprove services and fees for those services that arise between regularly scheduled meetings of the Audit Committee. In considering whether to preapprove the provision of non-audit services by the independent registered public accountant, the Audit Committee will consider whether the services are compatible with the maintenance of the independent registered public The Vanguard Group(2) 100 Vanguard Boulevard BlackRock Inc.(3) 55 East 52nd Street Nippon Life Insurance Company(4) 3-5-12 Imabashi Capital Research Global Investors (a division of Capital Research and Management Company (CRMC)(5) Jonathan Auerbach Mary E. Beams Betsy J. Bernard Jocelyn Carter-Miller Michael T. Dan C. Daniel Gelatt Sandra L. Helton Roger C. Hochschild Scott M. Mills Diane C. Nordin Blair C. Pickerell Clare S. Richer Alfredo Rivera Elizabeth E. Tallett Timothy M. Dunbar Patrick G. Halter Daniel J. Houston Deanna D. Strable-Soethout(6) Luis Valdés All Directors and Executive Officers as a group (27 persons) Delinquent Section 16(a) Reports 2014 Plan(2) 2020 Directors Plan(2) 2021 Plan Total 2014 Plan 2020 Directors Plan Equity compensation plans approved by our shareholders(1) Equity compensation plans not approved by our shareholders Questions and Answers About the www.meetnow.global/MVC9L9P. The SEC rules allow companies to notify shareholders that proxy materials are available on the internet and to provide access to those materials via the internet. You may obtain paper copies of the proxy materials free of charge by following the instructions provided in the notice of internet availability of proxy materials. $22,000. You will have one vote for every share of Company Common Stock you owned on the Record Date. Votes will be counted by Computershare Trust Company, N.A. www.principal.com. In addition to satisfying the foregoing requirements, to comply with the universal proxy rules, shareholders who intend to solicit proxies in support of director nominees other than the Board’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the Securities Exchange Act of 1934 no later than March 22, 2025. www.principal.com. Net income attributable to PFG Net income attributable to PFG Net realized capital (gains) losses, as adjusted(1) Other after-tax adjustments Non-GAAP operating earnings Net realized capital gains (loses) GAAP net realized capital gains (losses) Recognition of front-end fee revenues Market value adjustments to fee revenues Net realized capital gains (losses) related to equity method investments Derivative and hedging-related revenue adjustments Sponsored investment fund adjustments Amortization of deferred acquisition costs Capital gains distributed—operating expenses Amortization of other actuarial balances Market value adjustments of embedded derivatives Capital gains distributed—cost of interest credited Net realized capital gains (losses) tax adjustments Net realized capital gains (losses) attributable to noncontrolling interest, after-tax Total net realized capital gains (losses) after-tax adjustments Net realized capital gains (losses), as adjusted Diluted earnings per common share Net income Net realized capital (gains) losses, as adjusted Other after-tax adjustments Non-GAAP operating earnings Stockholders' equity Stockholders' equity Noncontrolling interest Stockholders' equity attributable to Principal Financial Group, Inc. Net unrealized capital (gains) losses Net unrecognized postretirement benefit obligation Stockholders' equity, excluding AOCI other than foreign currency translation adjustment, available to common shareholders Net income ROE available to common stockholders (including AOCI) Net income ROE available to common stockholders (including AOCI) Net unrealized capital (gains) losses Net unrecognized postretirement benefit obligation Net income ROE available to common stockholders (x-AOCI other than FCTA) Net realized capital (gains) losses Other after-tax adjustments Non-GAAP operating earnings ROE (x-AOCI other than FCTA) Book value per common share including AOCI Book value per common share including AOCI Net unrealized capital (gains) losses Net unrecognized postretirement benefit obligation Book value excluding AOCI other than foreign currency translation adjustment Foreign currency translation Book value per common share excluding AOCI Total revenues Total revenues Net realized capital (gains) losses, net of related revenue adjustments Adjustments related to equity method investments Non-GAAP operating revenues Net revenue Net revenue Operating expenses Non-GAAP pre-tax operating (earnings) losses attributable to noncontrolling interest(2) Pre-tax net realized capital gains (losses) Pre-tax other adjustments Certain adjustments related to equity method investments and noncontrolling interest Income before income taxes Income before income taxes Income before income taxes Net realized capital (gains) losses Net realized capital (gains) losses pre-tax adjustments Non-GAAP pre-tax operating (earnings) losses attributable to noncontrolling interest(2) Income taxes related to equity method investments Other after-tax adjustments Non-GAAP pre-tax operating earnings Income from continuing operations before income taxes Income from continuing operations before income taxes Net realized capital (gains) losses Net (income) losses attributable to noncontrolling interest Non-GAAP pre-tax operating income Net income attributable to noncontrolling interest Net income attributable to noncontrolling interest Income taxes attributable to noncontrolling interest Net realized capital gains (losses) attributable to noncontrolling interest, after-tax Non-GAAP pre-tax operating earnings (losses) attributable to noncontrolling interest Withwith Terms Expiring in 2022 Michael T. Dan

Age: 70Director Since: 2006 Committees: Human Resources and Nominating and GovernanceMr. Dan was Chairman, President and Chief Executive Officer of The Brink's Company, a global provider of secure transportation and cash management services, from 1999-2011. The Brink's Company had 70,000 employees worldwide, operations in over 100 countries and $3.8 billion in revenue in 2011. Prior to joining Brink's, Mr. Dan served as President of Armored Vehicle Builder, Inc.Skills and Qualifications: In addition to leading and being responsible for financial management of Brink's, Mr. Dan has executive level experience in international operations, risk management, talent management, strategic planning, brand management, executive compensation, customer service, marketing and mergers and acquisitions.Education: Studied business and accounting at Morton College in Cicero, Illinois, and completed the advanced management program at Harvard Business School. Sandra L. Helton

Age: 71Director Since: 2001 Committees: Audit (Chair), Finance and ExecutivePublic Directorships: OptiNose, Inc. (Chair of Audit Committee), Covetrus Inc. (Chair of Audit Committee, member of Nominating and Governance Committee)Former Public Directorships/Past 5 Years: Covance, Inc.; Lexmark International, Inc.Ms. Helton was Executive Vice President and Chief Financial Officer-Telephone and Data Systems, Inc. ("TDS"), a diversified telecommunications organization that includes United States Cellular Corporation, from 1998 through 2006. In her role, Ms. Helton had responsibility for the Finance, Information Technology, and other corporate functions. Prior to joining TDS, Ms. Helton spent 26 years with Corning Incorporated, where she held engineering, strategy and finance positions, including Senior Vice President and Treasurer from 1991-1997. She also served as Vice President and Corporate Controller of Compaq Computer Corporation from 1997-1998.Skills and Qualifications: Ms. Helton has global executive level experience in corporate strategy, finance, talent management, accounting and control, treasury, investments, information technology and other corporate administrative functions, as well as extensive corporate governance experience.Education: Bachelor's degree in mathematics, summa cum laude, from the University of Kentucky, and an S.M. from Massachusetts Institute of Technology's Sloan School with double majors in Finance and Planning & Control. ![[MISSING IMAGE: ph_blairpickerell-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_blairpickerell-bw.jpg)

10 2021 Proxy Statement![]()

64

67

Director Since: 2015

Committees: Finance and Nominating and Governance

Directorships:Company Boards:(Risk(Chair of the Risk Management and Compliance Committee and a member of the Audit Committee); First Pacific Company Limited (Finance and Corporate Governance Committees)Former Public Directorships/Past 5.LimitedMr. Pickerell served as Head of Asia of Nikko Asset Management from 2010-2014 and Chairman Asia from 2014-2015. From 2007-2010, he was CEO, Asia, at Morgan Stanley Investment Management. He has also served as Chief Executive, Asia Pacific, of HSBC Asset Management and as Chairman of Jardine Fleming Funds.Mr. Pickerell's current international service includes memberships on the Supervisory Committee for the Tracker Fund of Hong Kong; on the International Advisory Council of the Faculty of Business and Economics of The University of Hong Kong; and Chairman of the Harvard Business School Association of Hong Kong.Skills and Qualifications: In addition to his extensive leadership record in the investment and asset management and financial services industries, Mr. Pickerell has executive level experience in retail consumer, talent management, international, marketing, mergers & acquisitions, product development and strategic planning. He is fluent in Mandarin Chinese.Education: Bachelor's and master's degrees from Stanford University and an M.B.A. from Harvard Business School.Limited. ![[MISSING IMAGE: ph_richerclare-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_richerclare-bw.jpg)

Director Since: 2020

Committees: Audit, Finance (Chair) and Executive

Clare S. Richer

Age: 62Director Since: May 2020 Committees: Audit and Finance (Chair)Public Directorships: Bain Capital Specialty Finance Co. (member of the Audit, Compensation and Nominating/Governance Committees), State Street Global Advisors SPDR ETF Mutual Funds (member of the Audit Committee), Trustee of the University of Notre Dame (member of the Compensation, Investment, Finance and Audit Committees), and the Alzheimer's Association, MA/NH.2008-2017 and has more than 25 years of investment management experience.2008 to 2017. Prior to joining Putnam, Ms. Richer held several roles at Fidelity Investments from 1983-2008.

1983 to 2008.Qualifications: In addition to having deep experience in governance, compliance and risk in highly volatile, heavily scrutinized environments,Qualifications: Ms. Richer hasbrings to the Board extensive executive levelleadership experience, including through her service as a chief financial officer of a global asset management firm. She also brings to the Board executive-level experience in accounting and finance, asset and investment management, executive compensation, financial services, human resources and talent management, product development, risk management, strategic planning, and technology. Notice of 2024 Annual Meeting of Shareholders and Proxy Statement 14 ![[MISSING IMAGE: ph_mitchellliz-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_mitchellliz-bw.jpg)

Director Since: 2022

Committees: Audit and Finance

![]()

2021 Proxy Statement 11Withwith Terms Expiring in 2023 ![[MISSING IMAGE: ph_auerbachjonathan-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_auerbachjonathan-bw.jpg)

58

61

Director Since: 2019

Committees: Finance and Nominating and Governance has beenwas Executive Vice President, Chief Strategy, Growth and Data Officer of PayPal Holdings, Inc. since 2015. In his role, he leads PayPal's, a financial technology company, from 2015 until 2023. He led PayPal’s global strategy, acquisitions, partnerships, advanced analytics and data science, and growth marketing, and corporate affairs teams.heMr. Auerbach was Chief Executive Officer of SingTel'sSingTel’s Group Digital Life from 2013-2014 and spent over 26 years with McKinsey & Company, serving in a variety of executive roles in Asia and North America, including leading the Asian Telecommunications, Media and Technology Practice, the Singapore Office, and Southeast Asia Region, and the North American High-Tech Practice.hasbrings to the Board executive levelleadership experience through his service as an executive vice president of a financial technology company, as well as executive-level experience in international mergers & acquisitions,operations, financial services, marketing, product development, risk management, strategic planning, sustainability/ESG, and technology. Bachelor's Bachelor’s degree from Dartmouth College, and a B.A. and M.A. from Oxford University. Notice of 2024 Annual Meeting of Shareholders and Proxy Statement 15 ![[MISSING IMAGE: ph_beamsmaliz-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_beamsmaliz-bw.jpg)

Director Since: 2021

Committees: Audit and Finance Mary E. Beams

Age: 64Director Since: February 2021 Committees: FinanceFormer Public Directorships/Past 5 Years: BrightSphere Investment Group (Audit and Compensation Committees)CEOChief Executive Officer of Retirement Solutions at Voya Financial Inc. from 2011 until 2015. She also served as Counselor at the Department of State from June to December 2017. sheMs. Beams served in various executive leadership roles, including serving as President and Chief Executive Officer of TIAA-CREF Individual & Institutional Services, LLC from 2004 to 2010; Partner and Managing Director of Zurich Scudder Investments, Inc. from 1997 to 2003,2010, Senior Managing Director of Fleet Investment Advisors, Inc. from 1993 to 1997;1997, Senior Vice President of Retail Banking of Citibank from 1984 to 1988, and Director of the Consumer Card Group of American Express Company from 1988 to 1993;1993.Senior Vice Presidentwas a former Counselor of Retail Bankingthe Department of Citibank from 1984 to 1988.

State.hasbrings to the Board executive levelexperience, including through her service as a chief executive officer of a retirement services solutions business unit of a health, wealth and investment management public company. She also brings to the Board executive-level experience in accounting and finance,financial services, asset and investment management, consumer (retail), institutional, executive compensation, financial services, human resources/talent management,accounting, international marketing, distribution, mergers and acquisitions, productoperations, products development, risk management, strategic planning, sustainability/ESG and technology. Bachelor's Bachelor’s degree in English from Boston College, a Certificate of Special Studies in Strategic Planning from Harvard University, and an M.B.A. in Marketing and Finance from Columbia University. 12 2021 Proxy Statement![]()

Jocelyn Carter-Miller

Age: 63Director Since: 1999 (Principal Life), 2001 (the Company) Committees: Human Resources (Chair) and Nominating and Governance

Other Public Directorships: Arlo Technologies, Inc. (Audit Committee, Chair of Compensation Committee); InterpublicCompany Boards: of Companies, Inc. (Audit and Executive Committees, Chair of Corporate Governance Committee)Former Public Directorships/Past 5 Years: Netgear, Inc. (Audit and Compensation Committees)

. Notice of 2024 Annual Meeting of Shareholders and Proxy Statement 16 ![[MISSING IMAGE: ph_jocelyn-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_jocelyn-bw.jpg)

Director Since: 1999

(Principal Life),

2001 (the Company)

Committees: Human Resources (Chair), Nominating and Governance and Executive since 2005, which specializes in the developmenta consulting and marketing of high performancemanagement firm that develops and markets high-performance educational and personal empowerment programming. She wasFrom 2002 until 2004, she served as Executive Vice President and Chief Marketing Officer of Office Depot, Inc. from February 2002 until March 2004, with responsibilityand was responsible for the company'scompany’s marketing for its 846 superstores, contract, catalog, and e-commerce businesses in the United States and Canada and operations in 15 other countries.sheMs. Carter-Miller was Corporate Vice President and Chief Marketing Officer of Motorola, Inc. with overall responsibility for marketing across itsthe company’s $30 billion revenue base and diverse businesses. She also had general management responsibility while at Motorola for Motorola’s network operations in Latin America, Europe, the Middle East and Africa. Prior to joining Motorola, she was Vice President of Marketing and Product Development at Mattel, Inc. Shenon-profit boards and is the Membership Chair for NACD Florida andBoard of Directors of nonprofit organizations, including The National Association of Corporate Directors. She was a former President of the League of Women Voters of Broward County.was a 2013is an NACD Directorship 100 Honoree,recipient and has been recognized as a Savoy Power 300: 2016 Most Influential Black Corporate Directors Honoree, and a 2017 DirectorsDirector & Boards Director to Watch. In addition to her marketing leadership background, Ms. Carter-Miller hasbrings to the Board executive levelleadership experience, as well as experience in marketing, brand management, and international operations, including through her service as executive vice president of a publicly traded company that provides products, supplies, and technology solutions. She also brings to the Board executive-level experience in accounting consumer, brand management, advertising, sales, multinational companies, international operations, marketing,and finance, executive compensation, human resources and talent management, mergers and acquisitions, product development, project management, strategic planning, technology and leadership development and training. She also has passed the certified public accountant exam.

training, risk management, product development, strategic planning, sustainability/ESG, and technology. Bachelor's Bachelor’s degree in Accountingaccounting from the University of Illinois and an M.B.A. in Finance and Marketing from the University of Chicago. She also has passed the certified public accountant examination. Notice of 2024 Annual Meeting of Shareholders and Proxy Statement 17 ![[MISSING IMAGE: ph_scottmills-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_scottmills-bw.jpg)

53

55

Director Since: 2016

Lead Director since 2020

Committees: Audit, Human Resources and ExecutiveMr. Mills has been Lead Director since January 2020. since January 1, 2018. Prior to that, he wasfrom 2018 through 2021. From 2015 through 2017, Mr. Mills served as Executive Vice President and Chief Administrative Officer of Viacom, Inc. from 2015 through 2017 and, a former multinational mass media conglomerate. He served as Executive Vice President of Human Resources and Administration of Viacom from 2012 to 2015. Prior to that, he was of Viacom's BET Networks unit, where he previously served as Chief Financial Officer and President of Digital Media. HeMedia of Viacom’s BET Networks unit. Prior to joining BET, he worked in investment banking and served as Deputy Treasurer for the City of Philadelphia before joining BET.

Philadelphia.hasbrings to the Board executive levelleadership experience and investment management experience through his service as a chief executive officer of an entertainment company and his prior work in asset and investment management. He also brings to the Board executive-level experience in accounting and finance, asset and investment management, executive compensation, human resources and talent management, financial services, marketing, product development, strategic planning, and technology. Bachelor's Bachelor’s degree in economics from the Wharton School of the University of Pennsylvania. ![[MISSING IMAGE: ph_muruzabalclaudio-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-044674/ph_muruzabalclaudio-bw.jpg)

Director Since: 2021